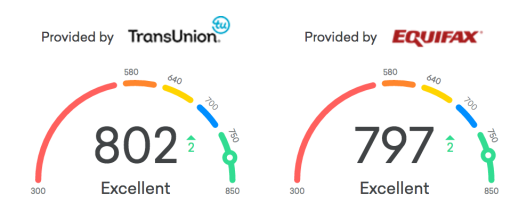

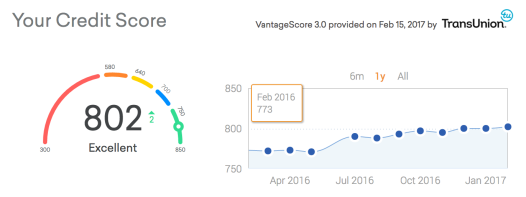

While applying for credit cards does typically ding your score, it’s not as bad as some people think. In fact, applying for credit cards (to take advantage of large signup bonuses) can actually have a positive effect on your credit score, when done correctly; trust me, I have the numbers to prove it.

There’s a balance to be had between having too many credit inquiries/new credit lines on your report and keeping your credit score high. Every year for the past few years, I have opened up at least 2 new credit lines, and my score has just been increasing.

Equifax seems unwilling to bump me up into the 800 club

The key thing that has helped me in maintaining a high credit score is having at least one credit card with a long credit history. Because your credit score takes into account the average age of all your open credit card lines, having one (or better yet, more) card(s) that is multiple years old really helps to balance out your average age of credit. I was lucky to have my financially-savvy dad open a credit line for me in my senior year of high school. I used this card during college to pay for books, dine out, and buy things I didn’t need on Amazon. This spending behavior actually ended up lowering my score at first, because I would always get up to over 50% utilization every month. But my Dad always made sure that the bills were paid in full and on time. Fast forward to my first job, and I’ve got an income and almost 6 years of credit history under my belt. When you always pay off your card in full, interest rates don’t matter. I started my first travel card application cycle the summer I started working full-time. I have since done a full cycle between the American Airlines, United Airlines, and Sapphire Preferred cards. Because the amount of money I can spend on a card is fairly low, I only feel comfortable going through one travel card a year. Those with high spending abilities can probably do this three or four times faster than me.

This post is about maximizing credit card points earnings without harming your credit score. Essentially, the “secret” to this is to set up your score so that applying for new cards won’t have a significant negative effect. Do that, and the positive effect of a new card (lowered utilization, more lines of credit) will just keep increasing your score, setting you up to apply for even better cards in the future.

Step 1: Have at least one no annual fee credit card that you keep open and in good standing. If you want to be more aggressive in maximizing credit card signup bonuses, balance that out with multiple credit lines. For that reason, don’t close out a card just because you don’t use it (unless that card is costing you money with an annual fee). I still have my student card that never gets used because it’s a non-rewards card. Closing it, however, would knock down my score by 60+ points easily, as it would reduce my average age of credit by two years.

Step 2: Check your credit score, regularly. There are many free options out there to help you check your score. Get in the habit of checking it once a week/month/whatever. Some people make the mistake of waiting until they actually apply for a card to know whether or not their score is high enough… which is silly! Only apply for products that you’re confident you’ll be approved for.

Step 3: Always pay your balances in full every month. Just set up auto-pay and be done with it; you’ll never have to worry about missing a payment, and paying your balances in full mean you won’t ever have to worry about paying interest, either.

Step 4: Track your spending for a few months. Get a sense of how much you actually spend on credit cards every month, as well as what categories you spend more in. This will factor into the right types of credit cards that are best suited for your lifestyle. Once you’ve done all that you can actually figure out what credit cards you want to apply for.

Step 5: Apply for a card! You’ll know your likelihood of being approved, whether you’ll be able to meet the spending requirement for the signup bonus, and whether your credit score can handle having an inquiry on it (which lasts for two years). Pro-tip: if you’re applying for multiple cards, do them all at once and it’ll only count as one hard inquiry on your credit report, not multiple.

It’s really not a hard process. For the most part, developing a good credit score requires patience and basic knowledge on how to not eff up. I’d love to know if anyone has any stories of major credit card strategy backfires, and what they did to adjust. In the meantime, I’m just going to continue amassing credit card points that I can redeem for cash and travel. It’s free money, so why wouldn’t you do the same?

Comments

Hey, first time commenting here! This was an interesting read, especially since you shared so many examples.

I myself still only have one credit card… But it’s a pretty old account. I’ve had it since college.

After reading this, I’ll have to consider getting a new rewards card soon because I feel like I’m leaving a discount on the table.