With my new financial resolutions to stay on top of, it was more important than ever for me to stay on top of my budget this month. Therefore, this month’s goal was incredibly simple: STICK. TO. MY. BUDGET. After all, what’s the point of even having one if you can’t follow it?

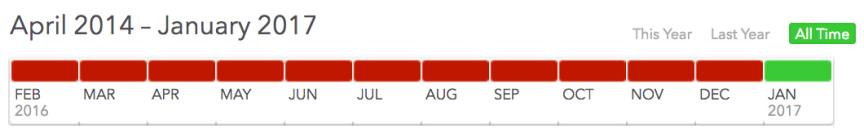

Behold! For the first time in a very long time, and definitely the first time since moving up to NYC, I stayed within my budget!

Did you know green has always been my favorite color?

As I mentioned in my Living on Less post, everyone has things that they can cut out of their spending. Of course, I was no exception. Here’s my spending breakdown for the month.

- Rent & Dance: $900. This is a no-touch category for me, so it’s the same month-to-month.

- Food & Dining: $450. We had visitors two weekends this month, which always increases this category, but also being at home at the beginning of the month for holidays helped keep this down.

- Public Transportation: $70. I went into the office fewer days this month than average, so this was also lower than average.

- Everything Else: $300. I budget $400 a month for this category. The only real reason I stayed within budget is because I spent less here.

Total: $1,720

As you can see, I like to keep my categories fairly simple. I don’t split out groceries from dining, although maybe I should start. While there are occasionally things that one has to buy (toilet paper, toothpaste, etc), the lower I keep my “Everything Else” category, the more likely it is that I don’t break the budget.

I’m very lucky to be paying so little in rent in a city that is known for its extremely high cost of living. I know for most of my friends living in a metropolitan area, my savings goals are not feasible. That said, I think extra money can always be shaved off of categories like dining out and shopping. Since my last cash fast, I’ve been able to keep my food expenses much lower than they were last year. $400 will continue to be my goal, but as long as I can keep this number below $500, I’ll be happy.

This month, I made my first donation to Kiva.org, which helps various people across the world by financing microloans. I contributed to a Columbian woman who operates an auto shop. For those of you who love personal finance as much as I do, this is a great way to give back. My miscellaneous category this month also included tickets to a Shakespeare-themed pub crawl, a late-night Uber, and some other small expenses – I may be saving aggressively, but I still have a social life!

My total budget for the month was $1,780. This is what’s leftover from my take-home pay (after 401k and taxes) with my savings goals subtracted. With the extra $60 this month (which isn’t much but hey, it’s not a negative number), I’m taking that money to get ahead of my dance payments. I’m currently committed through May and am paying for my lessons in lump sums, but only recognizing the expense in the month that the lessons occur. This means that I even though I budget a consistent amount each month, I’m really paying for two to three months at a time. Using my extra money this month on this will help me pay off my credit card bill when it needs to be paid, and I’ll also get a nice surprise in May! You’re welcome, future Jane.

I’m super pumped to finally have a successful Cash Fasting Challenge (guess third time’s the charm)! You can find a full list of challenges here. I would love ideas on future fasts! Perhaps one day I’ll actually do an actual fast. (By that, I mean a no-spend challenge.) Until then, my focus will continue to be on reducing expenses rather than cutting them out completely.

Comments

Congrats! Does your employer have a program that would allow you to use pre-tax dollars to pay for your public transportation?

Yes! It’s so confusing though – something on my list to tackle and take advantage of this year. I feel like employers make it extremely complicated on purpose to discourage people from taking advantage of it. I know I’m missing out on a couple hundred dollars a year by not using it.

Hmmm. I’ve never thought about breaking my budget up into so few categories. I tend to over-itemize and then I don’t keep up with it month to month.

And I made my first micro-loan to Kina this month! Looking closer at my finances is also helping me realize how far ahead I am than most of the world.

I had the same issue with too many categories, which is why I’ve set up my budget with these categories.

Yay for Kiva! I’ve made a second micro loan since this post was first published; and I love seeing the payments come back into my account, thinking about how much the beneficiaries have been able to accomplish.