Perhaps you want to get your financial situation in order, but you’re not sure where to start. Follow these four steps, and you can be on your way towards your financial goals this week.

1. Write out a budget. Make sure that you’re not spending more than you’re making.

You can do this in Excel, but I would recommend Google Sheets, so it’s reachable through multiple devices. Tools like Mint can also help provide a snapshot of finances and help you create a budget, but a separate one is useful for planning and forecasting purposes.

How do you create a budget?

There are many online resources to guide you with creating a budget. Let’s walk through a simplified version of it.

First, make a section for income. Have row for each income source you have, whether it’s your day job, side hustle, an annuity, or freelancing jobs. By having these income streams separated, you have the flexibility to adjust your monthly income, es

pecially if your income streams vary. Next, include rows for insurance premiums, retirement, and taxes – all costs that are taken from your salary before you get your paycheck. What’s leftover is your take-home pay, which should match what gets deposited into your account every pay period.

The next section is expenses. I like to have separate rows for rent, utilities, groceries, health & fitness, commuting costs, etc. Do what makes sense for you. If you have auto-deductions set up from your checking account, you can choose to include those under expenses, or in a separate savings section.

Total net gain/loss? Take home income – expenses – savings. If the number is positive, great. If you’re not, then obviously you’ve got some adjustments to make.

Pro-tip: automate as much of your budget calculations as possible. That way, you can immediately see the difference of reducing expenses, increasing your retirement contribution amount, or getting a promotion. I find that planning for adjustments a few months into the future gives me something to work towards.

Stay realistic. Budgets won’t work unless you stick to them.

2. Create at least one short-term (3-6 months) goal. Do it.

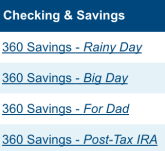

Don’t have a savings account? Open one. My personal favorite is  Capital One 360, which has no minimum balance requirements. You can subdivide 360 accounts as needed, which helps if you have multiple savings goals. If you’ve never been a 360 customer, you can get a free $25 account bonus when you open either a checking or a savings account with my referral link. (Full disclosure: I may also get a small bonus).

Capital One 360, which has no minimum balance requirements. You can subdivide 360 accounts as needed, which helps if you have multiple savings goals. If you’ve never been a 360 customer, you can get a free $25 account bonus when you open either a checking or a savings account with my referral link. (Full disclosure: I may also get a small bonus).

Your short-term goal can be as small as opening a savings account and putting in $100, or setting up a recurring deposit. You can also make a goal of saving up $500, or even $2,000. It needs to be something that is doable in 3-6 months. Why? Because it’s important not to lose steam. Small accomplishments like this are what keep us moving forward towards larger goals, like paying of $25K of student debt. That said, push yourself a little. If your goal is doable in less than three months, reach a little farther.

3. Create at least one long-term (12-18 months) goal. Plan for how you can accomplish it.

For me, my long-term goals are to pay off the rest of my student debt, replenish my emergency fund, and max out my 401k/IRA contributions. It may sound daunting, but they’re all reachable by the end of 2017.

Even if you don’t have any debt to pay off, there are plenty of long-term goals to focus on. You can save for your RTW trip, a large purchase (hello, massage chair), or a down payment of a car. Factor this goal into your budget, calculating how much you need to save per month in order to reach it. Set up a savings plan, preferably one that auto-deducts from your checking account the day you get paid. You can’t miss money if you never saw it in the first place.

4. Think of at least one really long-term (2-5 years) goal.

This is the toughest one, but also has the most room for creativity. Mine? In five years, I would like to have a 6 figure net worth, as well as a 6 figure salary. Long-term goals for me have definitely included promotion planning and relocation goals (anyone thinking over moving abroad?). This doesn’t (and arguably shouldn’t) be just tied down to a number. After all, the reason we’re embarking on this journey is to better finance the activities we enjoy doing, right? Money is great, but it’s not an end all be all. Even if it feels like it sometimes.

Whatever you choose, this goal is the one that keeps you motivated long-term. Buying a new phone all of a sudden seems less important if you know it will delay your move abroad by 2 months, or slow down other aspects of your life. That said, we can’t all be hermits. You’re going to slip one or many times, but the important thing is to travel in the direction that you’ve set out on. This isn’t a race to see who can conquer their goals first. Or is it…

Ready, set, save! (Too cheesy? Too cheesy.)